Resistance

We seemed to be hitting some resistance on the S&P 500.

Can the US market make a new high in the coming weeks ?

But didnt the "experts" say that we have this risk or that risk ?

Are you so frighten now, that you dont really know what to do ?

Do you know why you are buying or selling ?

The week in review:-

Commodities - Risk-Off

1. Oil - Lower. US$91.02 from US$93.36 last week from US$95.94 the previous week.

2. Gold - Lower. US$15.76 from US$1580 last week from US$1608 the previous week. Record US$1920. Vested.

3. Silver - Lower. US$28.60 from US$28.70 last week from US$29.78 the previous week. Range High: 49.50; Range Low: 29.68

4. Copper - Lower. US$3.52 from US$3.54 last week from US$3.74 the previous week.

Equities - Risk-Off

1. US Equities - Flat. 1518 from 1516 last week from 1519 the previous week. Support at 1457 ?

2. HK Equities - Higher. 22880 from 22782 last week from 23445 the previous week. Sold Rexlot & Sinopec

3.. Shanghai Equities - Higher. 2360 from 2314 last week from 2432 the previous week

4. Spore Equities - Lower. 3270 from 3288 last week from 3283 the previous week. No Trade

5. Japan Equities - Higher. 11606 from 11386 last week from 11174 the previous week.

Currencies - Risk-Off

1. USD to JPY - JPY Weaker. 93.59 from 93.41 last week from 93.52 the previous week. The 52 week range is 75.62 to 94.41.

2. SGD to MYR - MYR Stronger. 2.4956 from 2.5052 last week from the previous week. Vested. Upcoming GE a concern.

3. AUD to USD - AUD Weaker. 1.0207 from 1.0313 last week from the previous week.

4. AUD to SGD - AUD Weaker. 1.2657 from 1.2769 last week from 1.2749 the previous week; H 1.36; L 1.24; Vested

5. EUR to USD - EUR Weaker. 1.3028 from 1.3196 last week from 1.3364 the previous week.

6. USD to HKD - HKD Stronger. 7.7546 from 7.7545 last week from 7550 the previous week. 52 week range is 7.7495 - 7.7978. Vested

7. Dollar Index - Stronger. 82.27 from 81.44 last week from 80.46 the previous week.

Interest Rates - Risk-off

1. Yield on 10 Year Italian Bonds - Higher. 4.79% from 4.45% last week from 4.38% the previous week; Record 7.483%.

2. Yield on 10 Year Spanish Bonds - Lower. 5.10% from 5.15% last week from 5.19% the previous week. Line in the sand at 7.5% ?

3. Yield on 10 Year US Treasuries - Lower. 1.84% from 1.96% last week from 2.00% the previous week.

Others

1 Average Daily Turnover on HKEX - Lower. HK$71b from HK$66b last week from HK$52b the previous week.

2. Sentiment - Unease

3. Headwinds - European Contagion, Weak Global Economy, Elevated Commodity Prices, Deleveraging, Lower Margins, Weaker Earnings, Falling Property Prices, Tighter Credit Requirements, Downgrades by Rating Agencies, Austerity Programs, Iran, Demographics, Chinese Slowdown, Debt Ceiling Debates

4. Tailwinds - Low Interest Rates, EM Consumption, EM Demographics, Cash on Sideline, Cash in Corporations for M&A, Cash in short-term Bonds, Buybacks, Money-Printing, US Housing Recovery, China Recovery, Great Rotation

5. Risk Management - Cash is King or Trash ?

6. Properties - Prices still have not really come down despite all those curbs

7. Short-Selling & Buying Puts - No Set-Up yet

8. Friday's US Market Direction- Flat

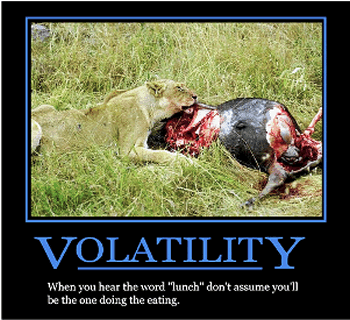

Can you stand the volatility now ?

Are you losing sleep because of your exposure to Equities ?

Are you willing to hold for 5 years, in case the market collapses tomorrow ?

Does the current Reward justify the current Risk ?

The above is to help me crystallize my thinking. It's not a recommendation to Buy or Sell. Use the above comments at your own risk and please do also feel free to provide me with your kind thoughts and comments

Please Note:-

Support the forum button- If you have benefited from the ideas in the forum but have not participated in the discussions, we would appreciate your kind support to defray the expenses of maintaining the forum.

Private Messages ( PM ) - Please do check your Inbox for any PMs. The Inbox is located on the top left hand corner of the Index Page.

Second Opinion - Please see the "Second Opinion" thread in the "Services for InvestIdeas Members" section, located just below the Miscellaneous Section.

Active Topics - Do you know that there's an "Active Topics" button? It's located on the top left hand corner of the Index Page.