by winston » Tue Feb 24, 2009 10:26 pm

by winston » Tue Feb 24, 2009 10:26 pm

Will the Yen Lose its “Safe Haven†Status as Japan’s Economy Deteriorates? By Keith Fitz-Gerald

Historically speaking, the Japanese yen has proved to be a safe haven against global turmoil. Right now, however, Japan’s economy is among the worst hit of all the global powers. It is ill prepared to weather the global storm and it’s falling like a rock.

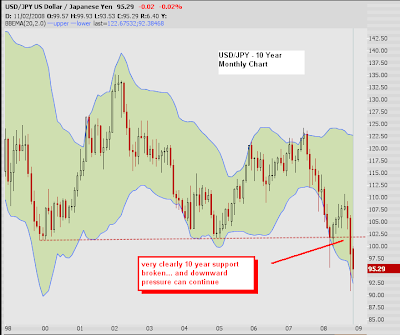

That’s why, this time around, as Japan’s economy falls away, I think there’s a very good chance the yen could drop as well.

Obviously, this would be very bad news for the huge numbers of speculators and institutions that have literally bet their existence on yen-based hedging strategies. But while a freefall in the yen would be a surprise to those institutional players, it would be about par for the course in my book, given the current state of the ongoing global financial crisis.

As reported, hedge funds have so far unwound gold, real estate, easy-to-sell stocks and other asset classes - so why shouldn’t they unwind currencies at some point, too? The same can be said for banks and other financial institutions currently embroiled in the global financial fiasco. With redemptions mounting, continued malfeasance like the $8 billion Stanford Financial scandal coming to light, and the credit markets still essentially locked-up tight, it’s not an unreasonable expectation.

Traditionally, analysts have looked to current-account balance statistics as a guidepost of sorts when the going gets tough. Specifically, analysts like to study surpluses on net foreign assets because those figures have historically indicated which currencies are expected to perform better during times of crisis.

The theory is that the higher the surplus, the more incentive a nation (and the companies in it) have to “repatriate†assets - that is, to bring them home. Therefore, traders tend to go “long†on the strongest, while simultaneously abandoning the weakest - or even shorting them outright.

And they have in record numbers. According to the Bank of Japan (BOJ), the yen remains near the highest nominal trade-weighted level it’s posted since November 2001. And while you’d think there would be some reduction in this “safety first†view of the yen - especially given recent U.S. announcements regarding the stimulus package - the fact is that there really haven’t been any serious reductions in the net-long yen position.

Indeed, the latest data from DanskeBank A/S shows that, in recent weeks, speculative investors have only reduced net long Japanese yen positions to some $6 billion dollars. It also reflects that traders tracked by the U.S. Commodity Futures Trading Commission (CFTC) remain net short all other major currency pairs which directly contradicts what Washington thinks and is telling the public about a recovery.

In fact, data drawn from the CFTC suggests that not only is the yen still viewed as a safe-haven currency, but that traders don’t buy into a U.S. recovery. In fact, traders are actively betting against a global recovery, at least as far as the major currency trading pairs are concerned.

There’s no similar data available from China, since its currency is partially blocked at the moment, but I’m hearing from traders all over the world that they’re assembling large-scale positions in China’s renminbi (yuan). If that’s true, this development will support my long-held contention that China is the real key to solving this mess, and my belief that China’s currency is poised to become every bit as viable as the dollar or the yen - if not more so, given the current global financial crisis.

The problem is that money is still flowing out of Japan and into foreign equities and bonds when it should still be flowing in. Consequently, some people like the institutional traders and speculators who have assembled the more than $6 billion in long positions in the Japanese yen argue that this is a temporary happenstance and one that, in fact, creates an even greater incentive to eventually repatriate the assets.

But I’m not so sure.

For one thing, the fact that “everybody†expects a stronger yen is the sort of contra-indicator that raises the hair on the back of my neck. Anytime the markets have such unified, blanket expectations, the unthinkable becomes possible, particularly if what everybody believes appears in print.

To illustrate what I mean, allow me to turn to the vaunted “magazine cover-story indicator,†which actually has a statistical basis as a contrarian warning.

Two of my favorite examples include the 1999 Economist cover story, “Drowning in Oil,†which stated that crude oil would fall to between $5 and $10 a barrel, and remain there for the next decade, and the infamous 1979 Business Week cover story, “The Death of Equities.†Less than a year later after the former was published, oil was trading at more than $25 a barrel. As for the latter, it preceded one of the greatest bull market run-ups in history.

Then there’s the fact that the Japanese economy is suffering its worst economic contraction in 35 years, and a recession that may be the worst in 50 years. According to Japan’s Ministry of Finance, the country’s industrial production is tanking to the tune of 30% this year, while its gross domestic product (GDP) may plummet 12% in a mere 12 months.

While this is unfolding, exports plunged thanks to non-existent overseas demand for the cars and electronics that have long been the mainstay of Japan’s industrial might. Overall, shipments to the United States - long Japan’s trading partner of choice - have plunged a staggering 34%.

The Wall Street Journal recently reported that Japan is running its first trade deficits in a generation - five months in a row at last count. This is especially problematic because Japan and China - together with South Korea - are the world’s largest purchasers of U.S. debt.

So at a time when the United States is trying to save its financial system and jump-start its economy by pumping trillions of dollars into the world financial system - and desperately needs global buyers to buy this new debt so that it can forge ahead with its rescue plans - Japan may not have the financial wherewithal to help make this happen. And China and South Korea may simply elect not to buy any more.

By all accounts, the fallout of all this turmoil is staggering. Japan’s economy may contract by 4.6% in 2009, Kyohei Morita, chief economist for Barclay’s Capital (ADR: BCS), told BusinessWeek recently.

Toyota Motor Corp. (ADR: TM) is projecting a worsening situation and a string of mounting losses that will be the first since 1938. Every single digit of yen appreciation is projected to cost the company an additional $450 million in operating losses.

According to The Tokyo Shinbun, more than 30% of Japan’s prefectures (governmental bodies larger than cities, towns, and villages) have already implemented emergency economic measures of their own. Overall, unemployment rose to 4.4% in December, the worst such figure recorded in 42 years. Tent cities are growing and many public parks are now overflowing with homeless people - something I recall seeing during the depths of Japan’s last “Lost Decade.â€

My friends tell me that factories in the normally highly industrialized Osaka area have shifted to 15-day-a-month production schedules, and many salarymen (Japan’s iconic office superheroes) are being encouraged to seek “arubaito†- or part-time work - to make ends meet. And those are the people who are still fortunate to have jobs. My mother-in-law tells me that it’s becoming increasingly common to see these workers serving noodles or working in department stores, doing jobs that have historically been done by college kids.

Things are so bad that Prime Minister Taro Aso has an unprecedented approval rating of less than 10% and many normally respectful Japanese, including my ultra-reserved father-in-law, refer to him as an “uneducated blockhead.â€

I could go on, but I think you get the picture. It’s bleak and getting worse by the day in a nation that I have lived in during much of the last 20 years and come to love.

That’s why shorting the yen may wind up being one of the most fundamentally successful - and admittedly contrarian - investment choices we can make in today’s mad markets.

Source: Money Morning

It's all about "how much you made when you were right" & "how little you lost when you were wrong"