Crocs Sinks on Concern Allure Is Fading as Sales Drop

(802 : probably a good time to think through if it will be acquired)

http://www.bloomberg.com/apps/news?pid= ... refer=home

---------------

July 25 (Bloomberg) -- Crocs Inc. plunged 45 percent in Nasdaq trading after the shoemaker forecast earnings lower than its previous prediction, raising concerns that it may not be able to sell its colored foam clogs profitably.

Crocs may post its first drop in sales since it sold shares to the public in 2006 as retailers cut back on orders. Yesterday's decline contrasts with the sevenfold increase in the 20 months after the initial share sale, when investors bought on the hopes that forays into apparel and celebrity endorsements would sustain the company's revenue growth.

``It brings up serious questions about their business model,'' said Keri Spanbauer, a retail analyst at Minneapolis- based Thrivent Financial for Lutherans, which manages $73.2 billion of assets.

Crocs fell $4 to $4.95 at 4:01 p.m. in Nasdaq Stock Market composite trading, the biggest decline since its initial share sale in February 2006. That's down 93 percent from the stock's record high of $74.75 on Oct. 31. The shoemaker said retailers cut back on clog orders as U.S. consumers spend less.

With U.S. consumers tightening spending, Crocs' brand isn't strong enough to command prices four times those of its imitations, Spanbauer said. At Nordstrom Inc. stores, Crocs sell for $24.95 to $69.95 each. Similar clogs sell for as little as $5 on Wal-Mart Stores Inc.'s Web site.

International demand in the second quarter failed to make up for the decline in the U.S. or meet Crocs' expectations, Chief Executive Officer Ron Snyder said today on a conference call with analysts and investors.

Europe, Asia

Sales rose 13 percent in Europe in the second quarter and 65 percent in Asia, Crocs said yesterday. For the first quarter, they more than doubled in Europe and advanced 93 percent in Asia. International sales accounted for 42 percent of Crocs' total 2007 revenue, according to Bloomberg data.

Second-quarter profit dropped to 3 cents to 7 cents a share, while sales were $218 million to $223 million, Niwot, Colorado-based Crocs said. For the year, the company said it may break even, while revenue will be ``down modestly.''

The clogmaker had 2007 sales of $847.4 million, more than double 2006's $354.7 million. Earnings were $168.2 million, or $2 a share, up from $64.4 million, or 81 cents, the year before.

Analysts surveyed by Bloomberg estimated second-quarter profit, excluding some items, of 39 cents a share on sales of $248.2 million. For the year, they projected adjusted earnings of $1.68 on a 16 percent increase in revenue.

`It's a Fad'

``It's a fad, not an essential basic in the consumer's wardrobe,'' retail consultant Walter Loeb said in an interview. ``Many people have Crocs and, particularly with the weak economy, consumers may not be interested in new Crocs this year.'' Loeb is president of the Loeb Associates retail consulting firm in New York.

Sales growth in 2009 will be in the ``high single digits'' on a percentage basis, Snyder said on the call. The company fired 1,300 workers this year to reduce costs, primarily in manufacturing, to counter lower sales.

Crocs also is taking legal action against manufacturers imitating its shoe design. Some shipments of knockoffs were seized and destroyed, he said.

The U.S. market proved to be ``more challenging'' than the company anticipated, Snyder said yesterday in the statement. While Crocs fully sold its merchandise through many of its major accounts, retailers were ``extremely cautious'' with reorders, he said.

Cost Strategy

The footwear maker is shrinking itself to be profitable on the lower projected sales, and will cut costs throughout the year, Snyder said. The steps it already took, including closing a Canadian manufacturing facility and lowering headcount, were not enough to offset the slowdown in orders, he said.

The company needs to differentiate itself from imitators by better informing consumers about the shoes' bacteria- and odor- resistant material, called Croslite, Spanbauer said.

``When you see Crocs displayed, you don't see something that clues you in to the fact that it's a really special type of material that it's made out of,'' Spanbauer said. ``People are looking at the price these days more than brand, and that hurts them.''

Crocs first sold shares to the public in February 2006, offering 9.9 million shares at $21 each.

Established in 1999 by three Boulder, Colorado-based founders, including Lyndon V. Hanson, Crocs began selling shoes three years later. The clogs, which mold to the wearer's feet and are ventilated so air passes through, initially were intended as boating and outdoor footwear. Crocs supplies its shoes to 13,500 U.S. stores and 95 countries.

The widespread availability of both Crocs -- with their multiple holes and pliable texture -- and their imitators is one of the company's biggest problems, according to Spanbauer.

``It's not only that Crocs are everywhere,'' she said, ``the knock-offs are everywhere.''

Crocs Inc. (CROX)

44 posts

• Page 1 of 5 • 1, 2, 3, 4, 5

Crocs Inc. (CROX)

Crocs Inc. (CROX)

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: CROCS

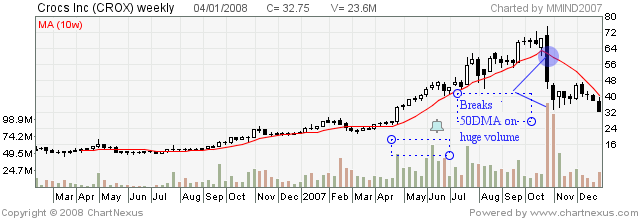

Crocs was once in the leaders group back in 2006/2007... the peak price was around USD69..

When it broke its 50DMA on huge volume on Nov 1 2007, it was USD48... shrewed investor should have gotten out cos' the institutional investors were bailing out...

Now it is around $5...

Here is another lesson - NEVER BOTTOM FISH and THE CHART NEVER LIES

Once institutional support is lost.. all hell breaks loose...

Remember - The value of a company is the price the last guy is willing to sell at..

When it broke its 50DMA on huge volume on Nov 1 2007, it was USD48... shrewed investor should have gotten out cos' the institutional investors were bailing out...

Now it is around $5...

Here is another lesson - NEVER BOTTOM FISH and THE CHART NEVER LIES

Once institutional support is lost.. all hell breaks loose...

Remember - The value of a company is the price the last guy is willing to sell at..

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CROCS

Paiseh, should have added a chart.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CROCS

crocs' most recent quarter earnings missed by (not a mile) galactical proportions...

look around, who's wearing crocs these days? even if u spotted one, it's probably a knock off.

in the first place, it's one ugly footwear (sorry, if i offended you)

look around, who's wearing crocs these days? even if u spotted one, it's probably a knock off.

in the first place, it's one ugly footwear (sorry, if i offended you)

Last edited by kennynah on Mon Jul 28, 2008 3:52 pm, edited 2 times in total.

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CROCS

Sound similar to one of the stock listed in Singapore.............Osim, imitation everywhere

- Winterflame

- Loafer

- Posts: 4

- Joined: Mon Jul 14, 2008 4:47 pm

Re: CROCS

Can't even provide outlook now...

-----------------------------

Crocs shares melt on big loss, dour outlook

http://www.reuters.com/article/ousiv/id ... 13?sp=true

-----------------------------

Crocs shares melt on big loss, dour outlook

http://www.reuters.com/article/ousiv/id ... 13?sp=true

SAN FRANCISCO (Reuters) - Crocs Inc (CROX.O: Quote, Profile, Research, Stock Buzz) posted a deep quarterly loss on Wednesday as sales of its once-trendy, colorful plastic shoes plunged and it racked up high restructuring costs, sending its shares down 37 percent in extended trading.

The former Wall Street darling also outlined several new measures to slash costs and streamline the bloated company, including shutting a Brazilian manufacturing plant and reducing capital expenditures for next year by 50 percent from 2008 levels.

"They've built an infrastructure over the last few years to handle what they though was a $2 billion company," said Sterne Agee analyst Sam Poser. "Now they'll have $500 million maybe."

Launched in Colorado in 2002, Crocs' quirky, bright and comfortable resin clogs quickly attracted a cult following and, within three years, the brand began attracting notice around the country.

People who spent time on their feet, whether doctors or cooks, cited their comfort, and parents bought them for their kids because of their fun colors and ease slipping on and off.

But the novelty of the original Crocs clogs has since waned and Crocs has branched out its business into new styles. The weak U.S. economy has further crimped demand and hampered investor interest in the stock.

"This is a good solid kids business. The adult part, the full lifestyle brand? Who knows?" said Poser, who tracks footwear companies, but does not cover Crocs specifically.

Since hitting a lifetime high of $75.21 in October of last year, Crocs shares have shed more than 97 percent of their value, closing at $1.90 Wednesday on Nasdaq.

Also on Wednesday, Microsoft Corp (MSFT.O: Quote, Profile, Research, Stock Buzz) founder Bill Gates reported a 5.6 percent passive stake in Crocs, amounting to 4.7 million shares, as of November 3.

BIG LOSS

In its third quarter ended September 30, Crocs had a net loss of $148 million, or $1.79 per share, compared with a net profit of $56.5 million, or 66 cents per share, a year earlier.

It was not immediately clear whether that was comparable to the 2 cents per share in profit expected, on average, by analysts polled by Reuters Estimates.

In August, Niwot, Colorado-based Crocs estimated quarterly earnings of 1 cent to 5 cents per share.

Results included a $70 million charge related to inventory write-downs, including products in certain colors expected to be marked down.

The company has been trying to cut back its infrastructure to be more in line with its future growth prospects. Its inventories, which fell 36 percent in the quarter, have been out of line with sales in recent months.

Analyst Poser said it was hard to know whether these inventory issues would recur.

"At this moment we can't assume this is the last we'll see of it," he said.

Sales fell 32 percent to $174.2 million, below the $201.7 million expected, on average, by Wall Street, and the $195 million to $205 million expected by Crocs.

Gross profit margins tumbled to 1.4 percent of revenues from 60.6 percent a year earlier.

Chief Executive Ron Snyder said the company lowered its projected sales volumes and would "right-size" operations. Capital spending in 2009 will be about half what it was this year, he added.

Crocs, which has been rolling out stores around the world even as it has cut staff, plans to be "very discriminate" in spending money on store openings, said Snyder. He added the company would still look at openings in various areas of the world, but had scaled back plans for 2009.

Crocs has been developing new product lines, where it said demand had been high, and has been refining its merchandising and distribution strategies.

Nevertheless, in addition to the dismal state of U.S. consumer spending, Crocs has been hurt by news its shoes can get caught in escalators and cause injuries, together with the plethora of knock-off shoes in the marketplace, and a recent European Union ruling that a Crocs patent is invalid.

Crocs estimated a fourth-quarter loss of 50 cents to 65 cents a share on revenue of $100 million to $120 million.

Wall Street, on average, had been expecting fourth-quarter sales of $185.7 million, according to Reuters Estimates.

The company said it would not provide a 2009 outlook due to "the uncertainty in the global economies."

Crocs shares dropped 37 percent to $1.20 in after-hours trading. The stock ended down 11.6 percent at $1.90 on Nasdaq, the lowest since May 2003.

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: CROCS

Seems to me pple are dumping this share..

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: Crocs Inc. CROX

In China, you can find a lot of good quality fakes of Crocs.

Maybe the company who make those buttons, that are inserted in the holes of crocs shoes, is a better buy. Those buttons are so expensive.

Maybe the company who make those buttons, that are inserted in the holes of crocs shoes, is a better buy. Those buttons are so expensive.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112616

- Joined: Wed May 07, 2008 9:28 am

Re: Crocs Inc. CROX

i havent seen people buying them anymore...

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Crocs Inc. (CROX)

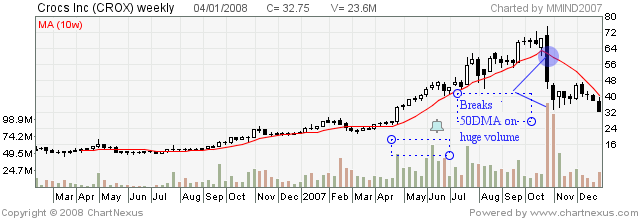

My last chart shows Crox trading at around $2.

Since the results is out, the price has gap down to about $1.

From the chart, it is pretty clear that there are already pple getting out of Crox on Nov 5. Pump and dump.

Edit:

Add chart below for easy reference

Since the results is out, the price has gap down to about $1.

From the chart, it is pretty clear that there are already pple getting out of Crox on Nov 5. Pump and dump.

Edit:

Add chart below for easy reference

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

44 posts

• Page 1 of 5 • 1, 2, 3, 4, 5

Who is online

Users browsing this forum: No registered users and 1 guest