Wing Tai

Re: Wing Tai

that's a smart move....i think can wait a bit more... in singapore...i dare say, not many are homeless...if cannt afford own place, stay with parents or rent temporarily...and so, property is rather demand elastic, which means, when demand drops off ...price can drop substantially...

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Wing Tai

February 6, 2009, 5.34 pm (Singapore time)

Wing Tai's Q209 net profit falls 52%

By KALPANA RASHIWALA

SINGAPORE - Property group Wing Tai Holdings has posted a 52 per cent year-on-year drop in net earnings for the second quarter ended Dec 31, 2008 to S$20.9 million. Turnover fell 17 per cent to S$91.98 million.

For the six months ended Dec 31, 2008, net earnings fell 49 per cent to $53.5 million.

No dividend has been declared.

Wing Tai's Q209 net profit falls 52%

By KALPANA RASHIWALA

SINGAPORE - Property group Wing Tai Holdings has posted a 52 per cent year-on-year drop in net earnings for the second quarter ended Dec 31, 2008 to S$20.9 million. Turnover fell 17 per cent to S$91.98 million.

For the six months ended Dec 31, 2008, net earnings fell 49 per cent to $53.5 million.

No dividend has been declared.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

Published February 7, 2009

Wing Tai changes tack as earnings fall

It will defer building housing projects where construction contracts haven't been awarded

By KALPANA RASHIWALA

PROPERTY group Wing Tai will defer construction of housing projects where construction contracts have not been awarded.

It did not name the projects in its second-quarter results statement yesterday but BT understands that they include proposed developments on the Ardmore Point and Anderson 18 sites.

The old Ardmore Point has been pulled down, leaving a vacant site, while the existing Anderson 18's units are largely vacant.

Market watchers reckon that Wing Tai and its joint venture partner for Anderson 18, City Developments, will probably consider the option of renting out the existing units to tide over the current weak property market until they decide to redevelop the site.

Wing Tai said: 'Property market conditions in 2009 are expected to remain challenging.'

The group posted a 52 per cent year-on-year drop in net earnings for the second quarter ended Dec 31, 2008 to $20.9 million. For the six months ended Dec 31, 2008, net earnings fell 49 per cent to $53.5 million.

The weaker first-half bottom line was due to a $50 million or 66 per cent fall in the group's share of profits of associated and joint venture companies as well as the absence of a $27.5 million one-off gain from disposal of an available-for-sale financial asset in Q2 of the preceding financial year.

Excluding the $27.5 million one-off gain, the group's operating profit in the latest first-half period ended Dec 31, 2008 increased by 34 per cent from $42.6 million to $57.2 million; the boost was due chiefly to higher profit recognition from development properties.

Units sold in Wing Tai's Helios Residences condo in Cairnhill, Riverine by the Park in Kallang and Belle Vue Residences at Oxley Walk in Singapore and Sering Ukay in Malaysia contributed to revenue and earnings for Q2 and H1 ended Dec 31, 2008.

Wing Tai said that the decline in share of profits of associated and joint venture companies was due to lower contribution from VisionCrest on the sale of residential units.

Q2 group revenue slid 17 per cent to $91.98 million, but the first-half revenue rose 7 per cent to $226.3 million.

Wing Tai's net gearing ratio stood at 0.47 time as at Dec 31, 2008, up from 0.4 time as at June 30, 2008. The group's total borrowings and debt securities stood at $1.15 billion as at Dec 31, 2008, up from $1.09 billion as at June 30, 2008. No dividend has been declared.

Net asset value per share excluding treasury rose one cent to $2.04 as at end-December 2008 from six months earlier.

Yesterday, the counter ended three cents higher at 71 cents. The stock has lost about 67 per cent of its value from the $2.19 peak on Feb 27 last year.

Wing Tai changes tack as earnings fall

It will defer building housing projects where construction contracts haven't been awarded

By KALPANA RASHIWALA

PROPERTY group Wing Tai will defer construction of housing projects where construction contracts have not been awarded.

It did not name the projects in its second-quarter results statement yesterday but BT understands that they include proposed developments on the Ardmore Point and Anderson 18 sites.

The old Ardmore Point has been pulled down, leaving a vacant site, while the existing Anderson 18's units are largely vacant.

Market watchers reckon that Wing Tai and its joint venture partner for Anderson 18, City Developments, will probably consider the option of renting out the existing units to tide over the current weak property market until they decide to redevelop the site.

Wing Tai said: 'Property market conditions in 2009 are expected to remain challenging.'

The group posted a 52 per cent year-on-year drop in net earnings for the second quarter ended Dec 31, 2008 to $20.9 million. For the six months ended Dec 31, 2008, net earnings fell 49 per cent to $53.5 million.

The weaker first-half bottom line was due to a $50 million or 66 per cent fall in the group's share of profits of associated and joint venture companies as well as the absence of a $27.5 million one-off gain from disposal of an available-for-sale financial asset in Q2 of the preceding financial year.

Excluding the $27.5 million one-off gain, the group's operating profit in the latest first-half period ended Dec 31, 2008 increased by 34 per cent from $42.6 million to $57.2 million; the boost was due chiefly to higher profit recognition from development properties.

Units sold in Wing Tai's Helios Residences condo in Cairnhill, Riverine by the Park in Kallang and Belle Vue Residences at Oxley Walk in Singapore and Sering Ukay in Malaysia contributed to revenue and earnings for Q2 and H1 ended Dec 31, 2008.

Wing Tai said that the decline in share of profits of associated and joint venture companies was due to lower contribution from VisionCrest on the sale of residential units.

Q2 group revenue slid 17 per cent to $91.98 million, but the first-half revenue rose 7 per cent to $226.3 million.

Wing Tai's net gearing ratio stood at 0.47 time as at Dec 31, 2008, up from 0.4 time as at June 30, 2008. The group's total borrowings and debt securities stood at $1.15 billion as at Dec 31, 2008, up from $1.09 billion as at June 30, 2008. No dividend has been declared.

Net asset value per share excluding treasury rose one cent to $2.04 as at end-December 2008 from six months earlier.

Yesterday, the counter ended three cents higher at 71 cents. The stock has lost about 67 per cent of its value from the $2.19 peak on Feb 27 last year.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

Published May 8, 2009

Wing Tai Q3 gain falls 23% to $21.4m

WING Tai Holdings has reported a 23 per cent drop in third-quarter group net profit to $21.4 million compared with a year ago. Revenue for the quarter ended March 31, 2009 slipped 19 per cent to $89.6 million.

For the nine months ended March 2009, Wing Tai's net earnings fell 44 per cent to $74.9 million and revenue dipped 2 per cent to $315.9 million.

Revenue in the latest nine months was recognised mainly from units sold in Helios Residences, The Riverine by the Park and Belle Vue Residences in Singapore.

Operating profit for the nine months slid 10 per cent to $91.7 million from a year earlier when it included a one-off gain of $26.6 million on the disposal of a financial asset.

The group's share of profits of associated and joint venture companies fell 71 per cent to $23.3 million due to a drop in sales of residential units at Vision Crest.

Gearing ratio stood at 0.48 times at March 31, 2009.

The group had cash and cash equivalents of almost $402 million at that date, up from $309.8 million at March 31, 2008.

Earnings per share fell to 2.74 cents for the latest Q3, from 3.27 cents a year earlier. Net asset value per share came to $2.12 at end-March 2009, higher than the end-June 2008 figure of $2.03.

Wing Tai said that property market conditions in 2009 are expected to remain challenging. 'In view of this, the group will continue to monitor the market closely and will exercise prudent management to ride through these difficult times,' it added.

There will be no dividend payout for the nine months ended March 31, 2009.

On the stock market yesterday, the counter closed 19 cents higher at $1.24.

Wing Tai Q3 gain falls 23% to $21.4m

WING Tai Holdings has reported a 23 per cent drop in third-quarter group net profit to $21.4 million compared with a year ago. Revenue for the quarter ended March 31, 2009 slipped 19 per cent to $89.6 million.

For the nine months ended March 2009, Wing Tai's net earnings fell 44 per cent to $74.9 million and revenue dipped 2 per cent to $315.9 million.

Revenue in the latest nine months was recognised mainly from units sold in Helios Residences, The Riverine by the Park and Belle Vue Residences in Singapore.

Operating profit for the nine months slid 10 per cent to $91.7 million from a year earlier when it included a one-off gain of $26.6 million on the disposal of a financial asset.

The group's share of profits of associated and joint venture companies fell 71 per cent to $23.3 million due to a drop in sales of residential units at Vision Crest.

Gearing ratio stood at 0.48 times at March 31, 2009.

The group had cash and cash equivalents of almost $402 million at that date, up from $309.8 million at March 31, 2008.

Earnings per share fell to 2.74 cents for the latest Q3, from 3.27 cents a year earlier. Net asset value per share came to $2.12 at end-March 2009, higher than the end-June 2008 figure of $2.03.

Wing Tai said that property market conditions in 2009 are expected to remain challenging. 'In view of this, the group will continue to monitor the market closely and will exercise prudent management to ride through these difficult times,' it added.

There will be no dividend payout for the nine months ended March 31, 2009.

On the stock market yesterday, the counter closed 19 cents higher at $1.24.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

Everyone's making money except you

Published August 26, 2009

Wing Tai posts loss of $53.9m in Q4

Results hit by $109.7m fair value losses on investment properties

By UMA SHANKARI

WING Tai Holdings yesterday reported a net loss of $53.9 million for the fourth quarter ended June 30, 2009, as it booked fair value losses of $109.7 million on its investment properties. Net profit in the same three months a year ago was $96.3 million.

Wing Tai sold just 100 homes with a total sales value of $208.5 million in Singapore in FY2009, but said its sales have picked up substantially since July.

Revenue in the three months, however, rose 78 per cent to $191.5 million, from $107.3 million in Q4 2008.

The fair value loss also hit the developer's full-year results. Net profit for financial year 2009 fell 91 per cent to $21.0 million, from $229.4 million for FY2008. Excluding the fair value losses on investment properties, the net profit of the group would have been $108.9 million in FY2009, compared with $157.8 million in the previous year, Wing Tai said.

Revenue for the full year rose 18 per cent to $507.3 million, from $428.2 million in the previous year, boosted by progressive sales recognised from its development properties Helios Residences, Belle Vue Residences and The Riverine by the Park in Singapore.

Wing Tai sold just 100 homes with a total sales value of $208.5 million in Singapore in FY2009, but said that its sales have picked up substantially since July. Since then, it has sold another 269 units with total sales proceeds of $575 million. Sales came from three projects - Belle Vue Residences, Ascentia Sky and Floridian.

Prices are also on their way up, at least at one of Wing Tai's projects. While earlier units in the upmarket Belle Vue Residences went for an average of $1,700 per square foot (psf), units sold later went for an average of $1,900 psf each, the company said. And some units were even sold for around $2,400 psf, said Wing Tai chairman Cheng Wai Keung. More than 80 per cent of the 120 apartments released at the 176-unit Belle Vue Residences have been sold to date.

At the 373-unit Ascentia Sky, more than 80 per cent of the 180 units released have been sold.

Remaining units at Belle Vue Residences, Ascentia Sky and Floridian could sell for more than those units sold so far, said Wing Tai deputy chairman Edmund Cheng. This is because units that are left are 'better' units, and could therefore be expected to fetch higher prices.

Looking ahead, Wing Tai chairman Mr Cheng said that being a cautious person, he did not believe that the current recovery in the property market was V-shaped - meaning that he does not expect a sharp rebound.

The mass market segment of the property market looks like it has recovered and could soon stabilise, he said. He was also 'cautiously optimistic' about the mid-range property market. But for the high-end segment (where Wing Tai's portfolio is concentrated), more growth is needed before we can be sure of a real recovery, Mr Cheng said.

'For the high-end segment, we need to create a lot more wealth in the economy than what we are seeing now,' Mr Cheng said. But wealth is 'coming back', he added.

For now, Wing Tai will ride on the positive market momentum and continue to market its residential pro-jects, it said. It has three more sites in its landbank that have yet to be launched.

Wing Tai's gearing rose from 0.4 times to 0.5 times from June 2008 to June 2009. FY2009 earnings per share fell to 2.68 cents, from FY2008's 30.11 cents.

The company declared a total dividend of 4 cents a share for 2009 (comprising a first and final dividend of three cents and a special dividend of one cent), down from a total of six cents a share for 2008. Excluding treasury shares and fair value gains/losses, EPS for FY2009 came to 13.9 cents, down from 20.7 cents. Based on this, the dividend payout ratio is maintained at 29 per cent.

Wing Tai shares rose 3 cents to close at $1.81 yesterday.

Published August 26, 2009

Wing Tai posts loss of $53.9m in Q4

Results hit by $109.7m fair value losses on investment properties

By UMA SHANKARI

WING Tai Holdings yesterday reported a net loss of $53.9 million for the fourth quarter ended June 30, 2009, as it booked fair value losses of $109.7 million on its investment properties. Net profit in the same three months a year ago was $96.3 million.

Wing Tai sold just 100 homes with a total sales value of $208.5 million in Singapore in FY2009, but said its sales have picked up substantially since July.

Revenue in the three months, however, rose 78 per cent to $191.5 million, from $107.3 million in Q4 2008.

The fair value loss also hit the developer's full-year results. Net profit for financial year 2009 fell 91 per cent to $21.0 million, from $229.4 million for FY2008. Excluding the fair value losses on investment properties, the net profit of the group would have been $108.9 million in FY2009, compared with $157.8 million in the previous year, Wing Tai said.

Revenue for the full year rose 18 per cent to $507.3 million, from $428.2 million in the previous year, boosted by progressive sales recognised from its development properties Helios Residences, Belle Vue Residences and The Riverine by the Park in Singapore.

Wing Tai sold just 100 homes with a total sales value of $208.5 million in Singapore in FY2009, but said that its sales have picked up substantially since July. Since then, it has sold another 269 units with total sales proceeds of $575 million. Sales came from three projects - Belle Vue Residences, Ascentia Sky and Floridian.

Prices are also on their way up, at least at one of Wing Tai's projects. While earlier units in the upmarket Belle Vue Residences went for an average of $1,700 per square foot (psf), units sold later went for an average of $1,900 psf each, the company said. And some units were even sold for around $2,400 psf, said Wing Tai chairman Cheng Wai Keung. More than 80 per cent of the 120 apartments released at the 176-unit Belle Vue Residences have been sold to date.

At the 373-unit Ascentia Sky, more than 80 per cent of the 180 units released have been sold.

Remaining units at Belle Vue Residences, Ascentia Sky and Floridian could sell for more than those units sold so far, said Wing Tai deputy chairman Edmund Cheng. This is because units that are left are 'better' units, and could therefore be expected to fetch higher prices.

Looking ahead, Wing Tai chairman Mr Cheng said that being a cautious person, he did not believe that the current recovery in the property market was V-shaped - meaning that he does not expect a sharp rebound.

The mass market segment of the property market looks like it has recovered and could soon stabilise, he said. He was also 'cautiously optimistic' about the mid-range property market. But for the high-end segment (where Wing Tai's portfolio is concentrated), more growth is needed before we can be sure of a real recovery, Mr Cheng said.

'For the high-end segment, we need to create a lot more wealth in the economy than what we are seeing now,' Mr Cheng said. But wealth is 'coming back', he added.

For now, Wing Tai will ride on the positive market momentum and continue to market its residential pro-jects, it said. It has three more sites in its landbank that have yet to be launched.

Wing Tai's gearing rose from 0.4 times to 0.5 times from June 2008 to June 2009. FY2009 earnings per share fell to 2.68 cents, from FY2008's 30.11 cents.

The company declared a total dividend of 4 cents a share for 2009 (comprising a first and final dividend of three cents and a special dividend of one cent), down from a total of six cents a share for 2008. Excluding treasury shares and fair value gains/losses, EPS for FY2009 came to 13.9 cents, down from 20.7 cents. Based on this, the dividend payout ratio is maintained at 29 per cent.

Wing Tai shares rose 3 cents to close at $1.81 yesterday.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

October 28, 2009, 5.30 pm (Singapore time)

Wing Tai sees Q1 profit rise 42%

By UMA SHANKARI

Wing Tai Holdings said that Q1 net profit rose 42 per cent to S$46.3 million, from S$32.6 million a year ago as a result of the higher operating profit achieved.

Revenue for the three months ended September 30, 2009 rose to S$277.2 million from S$134.3 million in the same three months last year.

This increase of 106 per cent in revenue is mainly due to the higher contributions from the development properties division as more units were sold in the current quarter, the company said. These include units sold in Belle Vue Residences and the progressive sales recognized from The Riverine by the Park in Singapore.

The property group's net gearing ratio was reduced to 0.48 times as at September 30 2009, as compared to 0.51 times as at June 30.

Wing Tai sees Q1 profit rise 42%

By UMA SHANKARI

Wing Tai Holdings said that Q1 net profit rose 42 per cent to S$46.3 million, from S$32.6 million a year ago as a result of the higher operating profit achieved.

Revenue for the three months ended September 30, 2009 rose to S$277.2 million from S$134.3 million in the same three months last year.

This increase of 106 per cent in revenue is mainly due to the higher contributions from the development properties division as more units were sold in the current quarter, the company said. These include units sold in Belle Vue Residences and the progressive sales recognized from The Riverine by the Park in Singapore.

The property group's net gearing ratio was reduced to 0.48 times as at September 30 2009, as compared to 0.51 times as at June 30.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

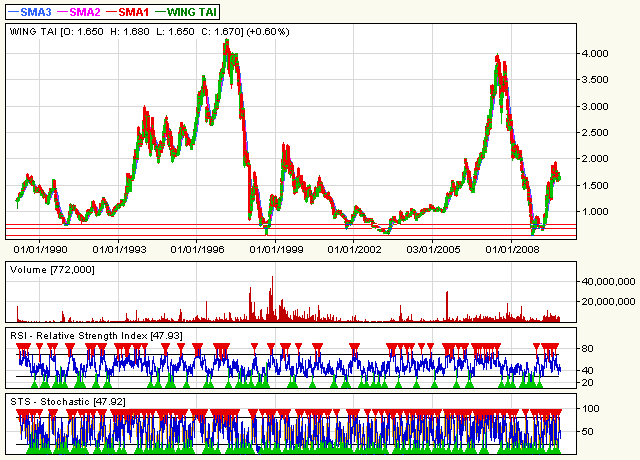

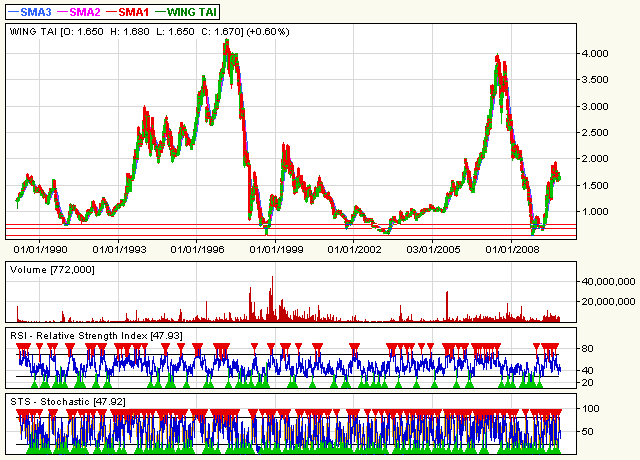

Notice the similarities???

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

Just need to point out that whenever there's a "M" forming, it's time to short the counter.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112722

- Joined: Wed May 07, 2008 9:28 am

Re: Wing Tai

Published February 6, 2010

Wing Tai posts 7% climb in Q2 net profit

By UMA SHANKARI

WING Tai Holdings yesterday reported a 7 per cent climb in fiscal second quarter net profit to $22.3 million from $20.9 million a year earlier as it sold more homes.

The rise in earnings for the three months ended Dec 31, 2009, came on the back of a 93 per cent surge in revenue to $177.1 million from $92 million a year ago. Q2 earnings per share climbed to 2.87 cents in Q2 from 2.67 cents the previous year. Net gearing stood at 0.5 times as at Dec 31, 2009.

Wing Tai in 2009 capitalised on the improved property market sentiments and marketed three new residential projects - Belle Vue Residences, Ascentia Sky by Tanglin and The Floridian - which were well received by home buyers.

For the half year ended Dec 31, 2009, the group's net profit rose by 28 per cent from $53.5 million to $68.7 million. Revenue doubled from $226.3 million to $454.3 million.

This increase was mainly due to the higher contributions from the development properties division as more units were sold over the six months, including units sold in Belle Vue Residences and the progressive sales recognised from The Riverine by the Park in Singapore, Wing Tai said.

Profits recognised from those projects also contributed to the increase in the group's operating profit from $56.6 million to $126.0 million for the first half of its financial year - an increase of 123 per cent.

Looking ahead, Wing Tai said that it will focus on marketing new residential projects and releasing more units for sale in 2010.

The group cited the growth forecast of the Singapore economy and its expected positive impact on the property market as the reasons behind its strategy.

Analysts remain upbeat about the high-end residential market in 2010.

'With the additional supply being part of the government's strategy to keep upgrader housing affordable, we expect that this will provide some price resistance for the mass-market this year,' said DBS Group analyst Adrian Chua in a note yesterday. 'We continue to favour the high-end segment and developers that are more exposed to this segment.'

Wing Tai shares shed four cents to close at $1.76 yesterday amid a weak market.

Wing Tai posts 7% climb in Q2 net profit

By UMA SHANKARI

WING Tai Holdings yesterday reported a 7 per cent climb in fiscal second quarter net profit to $22.3 million from $20.9 million a year earlier as it sold more homes.

The rise in earnings for the three months ended Dec 31, 2009, came on the back of a 93 per cent surge in revenue to $177.1 million from $92 million a year ago. Q2 earnings per share climbed to 2.87 cents in Q2 from 2.67 cents the previous year. Net gearing stood at 0.5 times as at Dec 31, 2009.

Wing Tai in 2009 capitalised on the improved property market sentiments and marketed three new residential projects - Belle Vue Residences, Ascentia Sky by Tanglin and The Floridian - which were well received by home buyers.

For the half year ended Dec 31, 2009, the group's net profit rose by 28 per cent from $53.5 million to $68.7 million. Revenue doubled from $226.3 million to $454.3 million.

This increase was mainly due to the higher contributions from the development properties division as more units were sold over the six months, including units sold in Belle Vue Residences and the progressive sales recognised from The Riverine by the Park in Singapore, Wing Tai said.

Profits recognised from those projects also contributed to the increase in the group's operating profit from $56.6 million to $126.0 million for the first half of its financial year - an increase of 123 per cent.

Looking ahead, Wing Tai said that it will focus on marketing new residential projects and releasing more units for sale in 2010.

The group cited the growth forecast of the Singapore economy and its expected positive impact on the property market as the reasons behind its strategy.

Analysts remain upbeat about the high-end residential market in 2010.

'With the additional supply being part of the government's strategy to keep upgrader housing affordable, we expect that this will provide some price resistance for the mass-market this year,' said DBS Group analyst Adrian Chua in a note yesterday. 'We continue to favour the high-end segment and developers that are more exposed to this segment.'

Wing Tai shares shed four cents to close at $1.76 yesterday amid a weak market.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Wing Tai

i am curious....does wing tai own Hotel81 chain of motels?

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Who is online

Users browsing this forum: No registered users and 1 guest